All aspects of catering an event must be added, from food and beverage provisions (and any other materials rented or purchased) to wait staff and continued food preparation and service.Ĭleaning (Housekeeping) Invoice – Provides itemization for a cleaning business or individual serving as a contractor, providing home or business cleaning services.Ĭommercial Invoices – When sending a package. TypesĪrtist Invoice – To bill for any kind of painting, drawing, or design workĪuto Body (Mechanic) Invoice – Detail the cost of parts and service hours when repairing a vehicle for a customer.Ĭatering Invoice – May be used to provide an initial estimate, for advance payment prior to a catered event or it may be used to bill a client after rendering of catering services for payment.

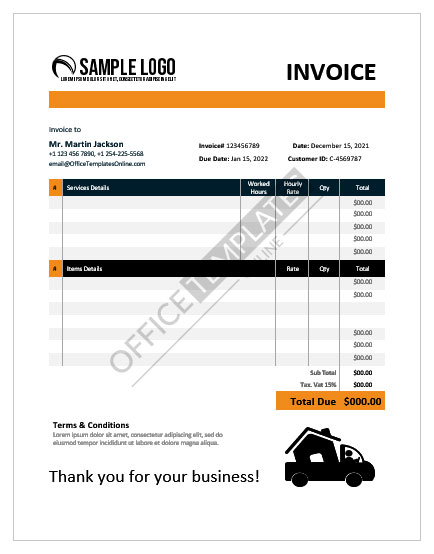

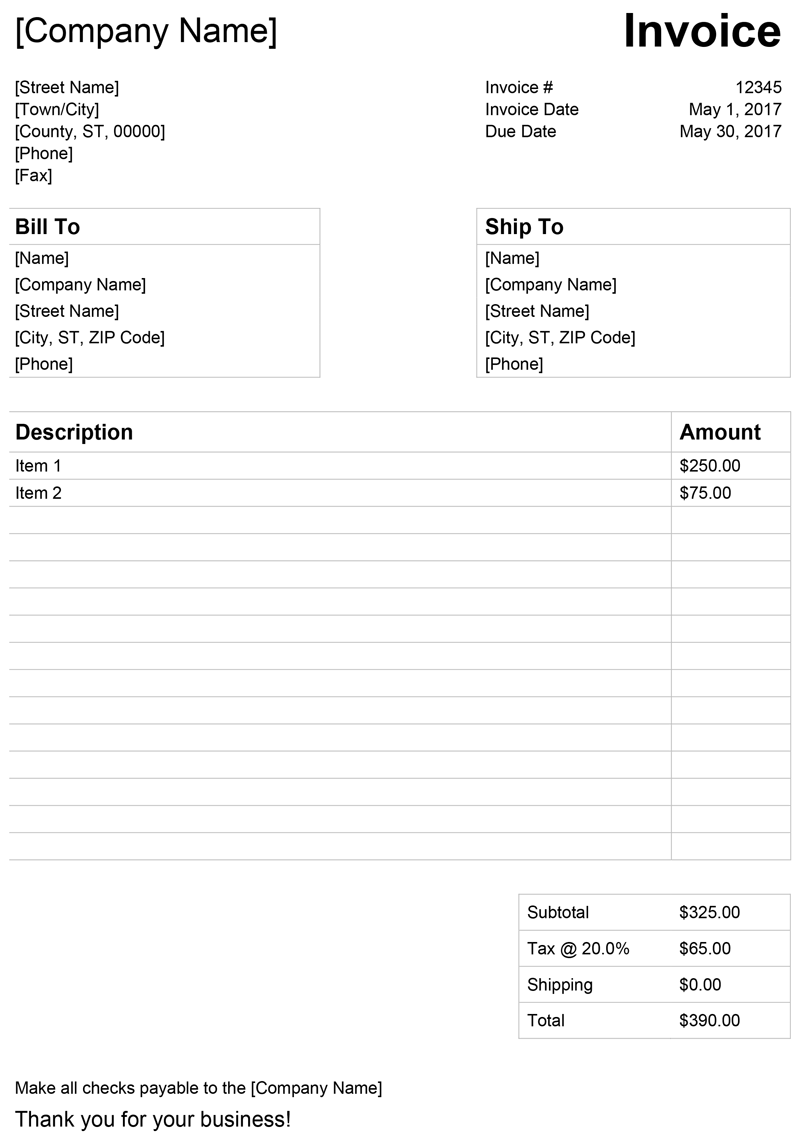

Once the Subtotal is calculated any taxes (sales, excise, municipal, etc) should be added to the total amount. The invoice is usually dated with the Company/Individual Logo along with a description of the product/service provided in a line-by-line setting. Be sure to double-check calculations, as few things can sour a working relationship more than a paycheck that comes out short.An invoice is a form that is generated by a company or individual and provided to a customer upon collection of a receivable for a product or service. If required, employers should deduct taxes before calculating the total to pay. It’s a clear case of spending money to make money: employees who feel recognized will usually repay in hard work and long-term loyalty. Independent contractors are generally exempt from these regulations, but full-fledged employees might be entitled to at least health insurance coverage and paid time off.Įven when not required by law, companies are often wise to provide employees with perks – whether in the form of vacation time, an annual bonus, or other incentives. Bonuses and benefitsĮmployers should make sure that they are in step with state and federal benefits rules. Are hours recorded on the honor system, or will workers clock in and out? How should increments of less an hour be reported? Since the invoice generally covers many working days, it is critical to ensure that employees are not merely completing it from memory at the end of the period (and possibly making costly errors). Tracking hours workedĮmployers should establish a procedure for tracking hours. More information on wage laws can be found at the US Department of Labor’s (DOL) website.īe aware that federal labor laws also generally require that employees be paid a higher overtime rate for any hours in excess of forty worked in a single week. Teen workers may be paid less for a brief period just after hire, and independent contractors are not covered by minimum wage rules. Servers and other employees whose earnings come primarily from tips are subject to a lower minimum wage – though rules for tipped employees vary by state too. There are some exceptions to the minimum wage law. Some states have legislated even higher wage floors, and wherever a state minimum is higher, it takes precedence over the federal standard. Minimum wage and pay ratesĪs a baseline, employers are generally required to pay workers at least the federal minimum wage. In some states, for example, the employer may be required to withhold state income taxes from wages. Other elements will vary with the specifics of the work arrangement and the local labor laws. Terms for payment and penalties for lateness.The subtotal that is due, any deductions, and the final balance that is due.The hourly pay-rate per task and total due for each task.Descriptions of all tasks completed, and time spent per task.In addition to contact information, dates, and other logistical basics, the Hourly Invoice should include: This document is both a formal record of work and a request for payment – so it should be completed with care. The employee or contractor may enter their information and hours worked at the end of their shift and the company or hiring individual may calculate total hours and pay to properly compensate the employee or contractor. An hourly invoice is a document that tracks hours worked by an employee or contractor being paid an hourly wage.

0 kommentar(er)

0 kommentar(er)